Even McDonald’s.

Maybe they never met Ray? Or his loyal Canadian subordinate, George?

Boom, Like That

I’m going to San Bernardino ring-a-ding-ding

Milkshake mixers that’s my thing now

These guys bought a heap of my stuff

And I gotta see a good thing sure enough now

Oh my name is not Crock, that’s Kroc with a K

Like crocodile but not spelled that way now

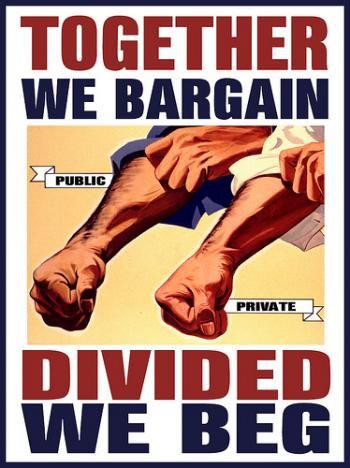

It’s dog eat dog, rat eat rat

Kroc-style… Boom! like that

Folks line up all down the street

Now I am seeing this girl devour her meat now

And then I get it Wham! as clear as day

My pulse begins to hammer then I hear a voice say:

These boys have got this down ought to be one of these in every town

These boys have got the touch It’s clean as a whistle and it don’t cost much

Wham! Bam! You don’t wait long, shake, fries, patty you’re gone

How about that friendly name, heck, every little thing ought to stay the same

Or my name is not Crock, that’s Kroc with a K

Like crocodile but not spelled that way now

It’s dog eat dog, rat eat rat

Dog eat dog, rat eat rat now

Oh it’s dog eat dog, rat eat rat

Kroc-style… Boom! like that

You gentlemen ought to expand

You’re gonna need a helping hand now

So gentlemen well what about me?

We’ll make a little business history now

Oh my name’s not Crock, you can call me Ray

Like crocodile but not spelled that way now

It’s dog eat dog, rat eat rat

Kroc-style… Boom! like that

Well we’ll build it up and I buy ’em out

But man they made me grind it out now

They open up a new place flippin’ meat

So I do too, right across the street

I got the name but I need the town, sell em’ in the end and it all shuts down

Sometimes you gotta be an S.O.B. you wanna make a dream reality

Competition sent em south, if they’re gonna drown put a hose in their mouth

Do not pass “Go”, go straight to hell

I smell that meat hook smell

Oh my name is not Crock, that’s Kroc with a K

Like crocodile but not spelled that way now

Ohh it’s dog eat dog, rat eat rat

It’s dog eat dog, rat eat rat

Ohh it’s dog eat dog, rat eat rat

Kroc-style… Boom! like that

I smell that meat hook smell

Posted by Les Stewart

Posted by Les Stewart